Casio Cloud Bulletin

How to change VAT Rates

Tech Bulletin

VAT Changes

HMRC Update

The Chancellor announced at Budget 2021 that the temporary reduced rate of 5% will be extended to 30 September 2021.

From 1 October 2021 the reduced rate for these supplies will be replaced by the introduction of a new reduced rate of VAT of 12.5% which will remain in effect until 31 March 2022.

For more information please visit: Guidance on the temporary reduced rate of VAT for hospitality, holiday accommodation and attractions – GOV.UK (www.gov.uk)

How to…

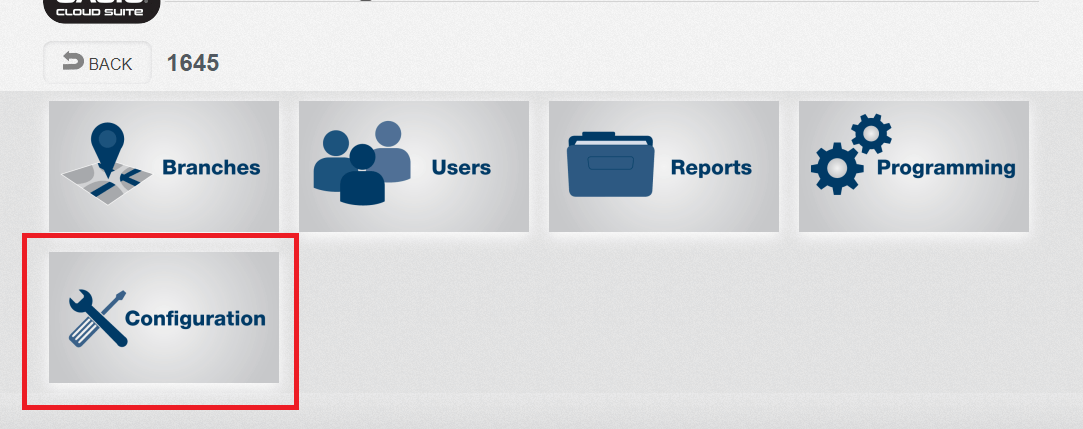

The below instructions can be followed to change the system VAT rates on the Casio Cloud Portal. The example shown is how to change the VAT rate to 12.5%.

Login to the Casio cloud.

Select Configuration

Select VAT

Edit your current 5% Special VAT rate if it exists. If not select Add New TAX Code

Ensure the TAX code is configured as follows:

Lastly, ensure you required products have the correct/new VAT code programmed